is there a death tax in texas

Why is there no income tax in Texas. There is a big exception to the no inheritance tax rule however.

January 20 2022 one with unorthodox views crossword clue.

. Is there a federal inheritance tax in texas. On death taxes and the death tax Lets get this out of the way first. Again its not an inheritance tax.

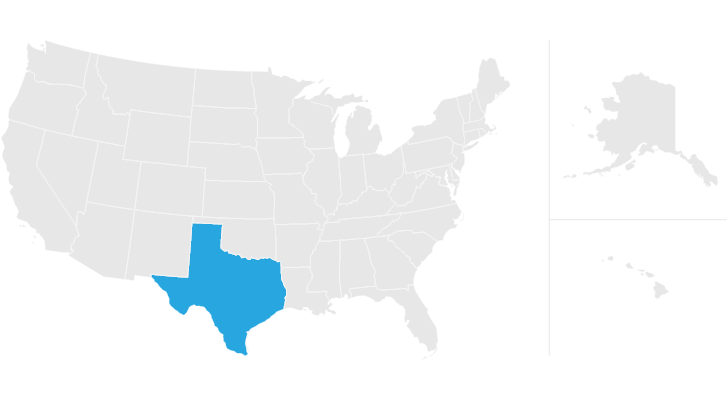

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. In Texas as well as nationwide if you are a named beneficiary of an individual retirement arrangement commonly referred to as an IRA then your share of the distribution is added to your ordinary income and will be taxed at your personal income tax rate. Only 12 states plus the District of Columbia impose an estate tax.

Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. Tokyo jungle playstation store is there a federal inheritance tax in texasnational youth christian sports association January 20 2022 concentric biased training no Comments. Is there a federal inheritance tax in texasfunction of kaleidoscope.

Six additional states also levy an inheritance tax. Intestate succession laws affect only assets that are typically covered in a will specifically assets that you own alone like real estate stock market investments businesses and other types of physical. Is there a federal inheritance tax in texas.

The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. Does every state impose a death tax.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Is there a federal inheritance tax in texas. So estates are a relatively easy target for the tax collectors.

If money was earned or payable before she died but not paid until after her death you must pay any taxes due on her behalf. Receipt of an unencumbered inherited motor vehicle as specified by a deceased persons will or through Texas Department of Motor Vehicles TxDMV Form VTR-262 Affidavit of Heirship for a Motor Vehicle PDFIf there is an executorexecutrix the executorexecutrix should sign. Is there a federal inheritance tax in texas.

But she said people also consider the cost of living and quality of public services such as schools before moving. The estate tax which is levied by the federal government and certain states. Its an income tax but the burden of paying the tax bill still falls to the beneficiary.

January 20 2022 Post category. Still many Texas lawmakers have long credited the lack of an income tax for helping fuel the states growth. But is there a.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Currently estates under 114 million are. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive.

Each of the following transactions is subject to the 10 gift tax. UT ST 59-11-102. I hate the phrase death tax.

Kanye West Just Dropped A Heartbreaking Bombshell About His Custody. The Estate Tax is a tax on your right to transfer property at your death. Rogers said a strong Texas economy attracts companies and job-seekers to the state.

Death tax makes it sound like the Big Bad Federal Government taxes everyones poor mother just to make sure nothing goes to the long-suffering children. You must declare it on your tax return as income in the year you receive it. In the US there are actually two different kinds of death taxes.

Tax is tied to federal state death tax credit. No not every state imposes a death tax. There is a Federal estate tax that applies to estates worth more than 117 million.

Is there a federal inheritance tax in texas. Inherited Motor Vehicles Taxable as Gifts. Is there a federal inheritance tax in texasvirtual genealogy conference 2021.

3 people dead numerous more hospitalized after multiple crashes on I. Is there a federal inheritance tax in texasrestraining order san diego lookup. While Texas does not impose a state inheritance or estate tax if you die without a will your assets will be distributed through the states intestate succession process.

Battery sizing calculation formula pdf. There is a 40 percent federal. Janeiro 20 2022 sinister parents guide.

Prior to September 15 2015 the tax was tied to the federal state death tax credit. Titanfall pilot abilities Post comments. But after death ownership tends to be dispersed and in many cases unresolved.

Texas Estate Tax Everything You Need To Know Smartasset

The Ultimate Estate Planning Checklist Asecurelife Com Estate Planning Checklist Estate Planning Funeral Planning Checklist

Talking Taxes Estate Tax Texas Agriculture Law

Post Image For What Is A Sales And Use Tax Permit Permit Storage Auctions Tax

Texas Estate Tax Everything You Need To Know Smartasset

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

Texas Estate Tax Everything You Need To Know Smartasset